California coast turns into shipping ‘car park’ as ports still full

The southern California coastline resembles a container freight car park with a record number of ships being forced to drift off the coast as berth spaces continue to be full and ports are unable to welcome and offload them.

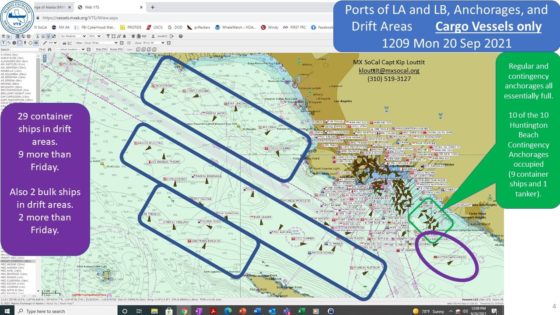

According to the Marine Exchange of Southern California, a non-profit organisation dedicated to the development and efficient flow of maritime commerce throughout the region, 37 vessels were in drift areas on 20 September, breaking the former record of 28 on 16 September. The mix is 29 container ships (breaks record of 23 on 16 September), six tankers, and two bulk ships.

The vessels are waiting for berth space at ports including Los Angeles and Long Beach.

Last week, Brendan Murray at Bloomberg reported: “The number of container ships waiting to enter the biggest U.S. gateway for trade with Asia reached an all-time high of 65 vessels, carrying potential payloads of cargo boxes that would stretch halfway across the country if lined up end to end.”

The Marine Exchange of Southern California’s daily report in the early hours of 21 September assessed that overall 154 total ships were in port (sum of at a berth, at anchor, and drifting), which was seven more than the proceeding Friday one short of the record of 155 set on Sunday 20 September.

According to Hong Kong-based Freightos, an online shipping marketplace, China to USA transit times for ocean freight reached 71 days door-to-door in September 2021, up from 40 days two years ago.

The delays are pushing transpacific freight costs to an all-time high.

The ports of Los Angeles and Long Beach have expanded the hours during which trucks can pick up and return containers as part of the plan to improve timings and unblock the bottleneck.

On a post on LinkedIn this month, Lars Jensen, CEO of container consultancy Vespucci Maritime says: “The core of the problem lies on the landside – shortage of trucks, chassis, rail infrastructure, drivers etc etc – all elements largely out of control of the carriers. The element which clearly is under the control of the carriers is how much vessel capacity they deploy. The only region globally where there is a strong demand boom (and has been throughout 2021) is North America. And the carriers have reacted by shifting capacity out of other trades where there is not a demand boom and into North America.”

The Marine Exchange of Southern California said on 21 September: “Due to the record number of ships drifting, we are letting them drift further out than our usual 25-mile VTS area so they have more space between them; there is lots of ocean appropriate so we are using it. It keeps everyone safe and comfortable. Regarding other vessel types, tankers are operating normally. Cruise ships without passengers are coming/going for food, fuel, changing crews, etc.”